LFT Algorithm Performance

18+ years of simulated trading results on historical gold market data

Important Disclaimer

Past performance is not indicative of future results. All data represents historical backtesting on simulated trades, not actual trading results. Trading involves substantial risk of loss.

2007-03-19 to 2025-10-14

Total Trades

Executed over all time

Win Rate

Percentage of profitable trades

Sharpe Ratio

Risk-adjusted return measure

Profit Factor

Gross profits / gross losses

Max Drawdown

$6300 peak-to-trough decline

Avg Trade Length

Low-frequency trading approach

Monthly Mean P&L

Average profit per month

Simulated Investment Growth

$30,000 hypothetical starting capital

Backtested Simulation

BACKTESTED SIMULATION

BACKTESTED SIMULATION

BACKTESTED SIMULATION

Advanced Risk Metrics

Detailed statistical analysis of trading performance

Distribution Metrics

Risk-Adjusted Performance

Deeper Performance Insights

Additional visualizations from our backtested data

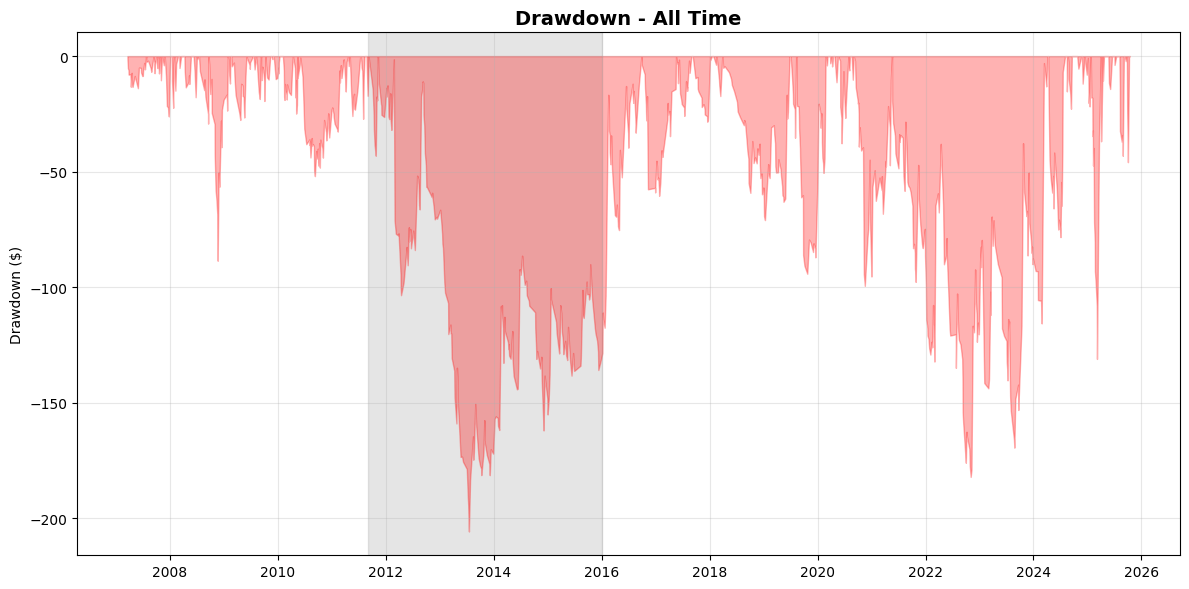

Drawdown Analysis

Drawdown measures how far the account value fell from its highest point before recovering. The red area shows temporary losses. Maximum drawdown of 21% means the worst peak-to-valley decline was $6,300 on $30,000 capital. Smaller drawdowns indicate more stable returns with less emotional stress.

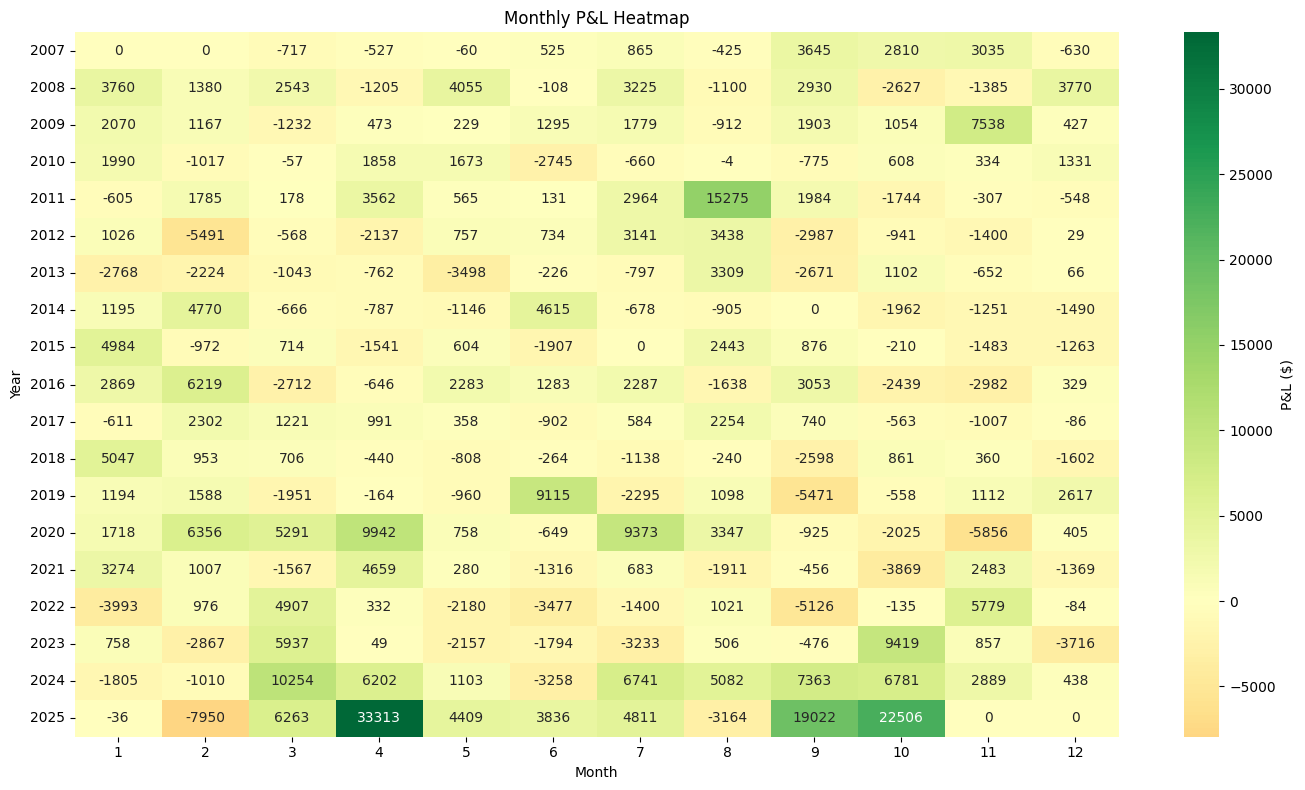

Monthly Performance Heatmap

Calendar view showing winning and losing months. Green = profit, Red = loss. Quickly see seasonal patterns.

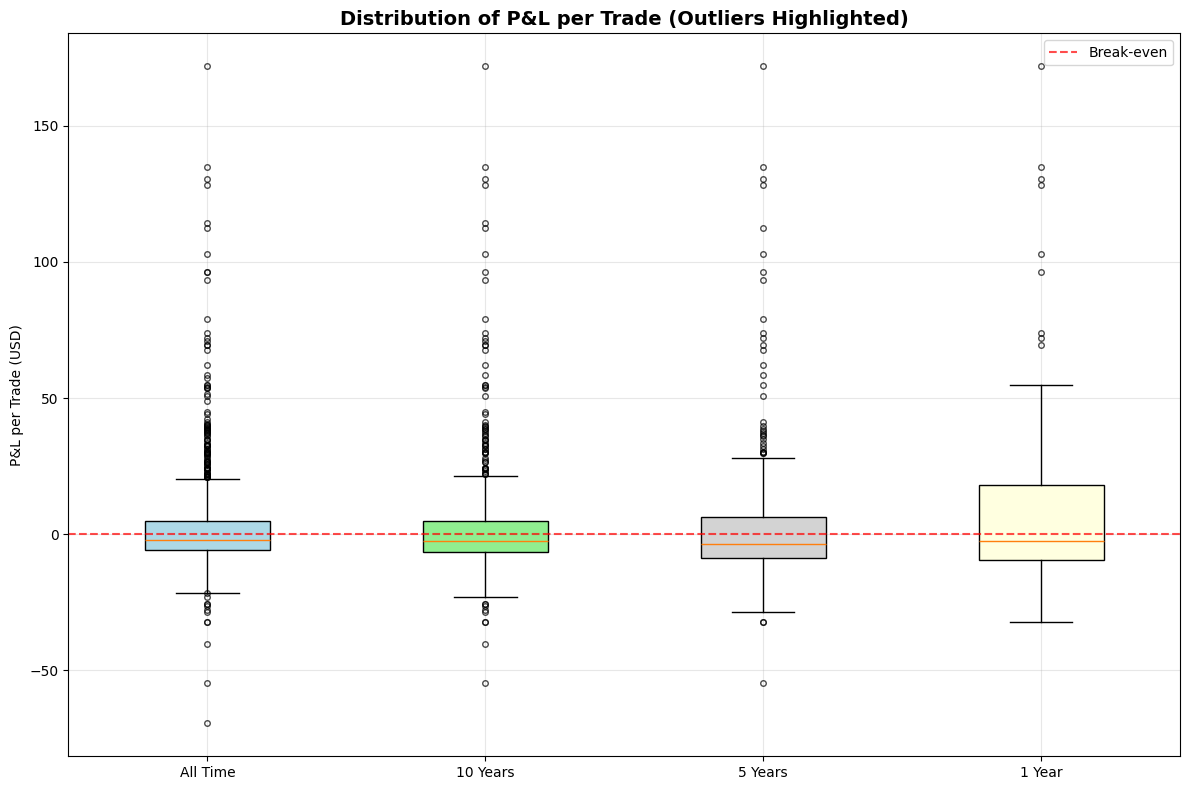

Distribution Consistency

Box plots show the distribution of trade results. The box represents the middle 50% of trades (from 25th to 75th percentile). The line inside is the median. Whiskers show the normal range, and dots are outliers. Tighter boxes mean more consistent performance with fewer extreme outcomes.

Understanding the Strategy

Why We Built This

Most indicators are made for stocks. They don't work well for gold.

Gold moves based on the dollar, inflation data, and Fed policy—not earnings reports or company news.

We built these indicators specifically for gold futures. Every signal is calibrated for how gold actually trades.

Frequently Asked Questions

Ready to Learn the Strategy?

These results represent backtested simulations. Start with free education to understand the methodology.

Disclaimer: Past performance is not indicative of future results. All data represents historical backtesting on simulated trades, not actual trading results. Trading involves substantial risk of loss.