The Opening Move

Determines the Game

In chess, grandmasters don't play every opening. They master a select few, deeply. The LFT method applies the same discipline to gold: fewer setups, longer timeframes, and patience over impulse.

Why Most Traders Fail (And How LFT Is Different)

The Day Trading Trap

- 50-100+ trades per day

- Constant screen time (8+ hours)

- High stress and emotional exhaustion

- Death by 1,000 paper cuts (commissions, slippage)

- No time to think—only react

- 95% failure rate

"You're not trading. You're gambling with better graphics."

The LFT Approach

- 5-15 high-quality setups per month

- 20-30 minutes of analysis per day

- Strategic, calculated moves

- Let positions develop over days/weeks

- Time to think, plan, and execute

- Built for professionals with day jobs

"Trading like a strategist, not a gambler."

In Chess: A beginner moves pieces constantly without purpose. A grandmaster waits, positions, then strikes decisively.

In Trading: Day traders chase every move. LFT traders position strategically and wait for the market to come to them.

Built on Three Unshakable Principles

PATIENCE

Time Is Your Advantage

The market rewards patience. By trading on higher timeframes (daily/4H), you filter out noise and see the true structure. LFT teaches you to wait for setups that meet ALL your criteria—not just some.

Key Concept: Setup Filtering

- Clear entry conditions

- Risk-reward minimum 2:1

- Confluence of multiple factors

POSITION

Strategic Positioning

Like a chess grandmaster, you don't just look at the current move—you anticipate three moves ahead. LFT integrates macro-thematic analysis: Fed policy, inflation data, geopolitical events. You position before the crowd reacts.

Key Concept: Macro Context

- Gold's role as inflation hedge

- Central bank policy impact

- Dollar correlation analysis

DISCIPLINE

Risk Management First

Every trade starts with "How much can I lose?" not "How much can I make?" LFT enforces strict position sizing, maximum daily loss limits, and mandatory breaks after drawdowns. Discipline is the difference between a trader and a gambler.

Key Concept: Risk Controls

- Fixed % risk per trade (1-2%)

- Hard stop at max daily loss

- News blackout windows enforced

From Analysis to Execution: The LFT Process

A systematic approach to trading gold, from macro analysis to post-trade review

MACRO ANALYSIS

Understand the Big Picture

Every week, analyze the macro environment:

- - Fed policy stance (hawkish/dovish)

- - Inflation trends (CPI, PCE data)

- - Dollar strength (DXY)

- - Geopolitical risk (wars, elections)

This tells you if gold is in a bullish or bearish regime.

TECHNICAL SETUP IDENTIFICATION

Find High-Probability Zones

Using daily and 4-hour charts, identify:

- - Key support/resistance levels

- - Trend structure (higher highs/lows)

- - Pattern formations (flags, wedges)

- - Volume confirmation

The LFT algorithm scans for these 24/7.

ALGORITHMIC CONFIRMATION

Wait for System Alignment

When multiple factors align, the LFT algorithm sends a notification:

'System Alignment Detected on Daily Chart'

This is NOT a command—it's an alert that YOUR criteria are met. You review the setup and decide if/how to execute.

RISK MANAGEMENT

Size and Protect Your Position

Before entering, calculate:

- - Position size (based on account and risk %)

- - Stop-loss placement (technical or volatility-based)

- - Take-profit targets (reward:risk ratio)

Never risk more than 1-2% per trade.

EXECUTION & MANAGEMENT

Enter, Monitor, Exit

Place your trade through your broker. Then:

- - Monitor daily (not every minute)

- - Adjust stops as position moves in your favor

- - Take profits at predetermined targets

- - Journal every trade for review

POST-TRADE ANALYSIS

Learn From Every Trade

Win or lose, analyze:

- - Did the setup meet all criteria?

- - Was execution clean?

- - What did you learn?

This feedback loop is how you improve over time.

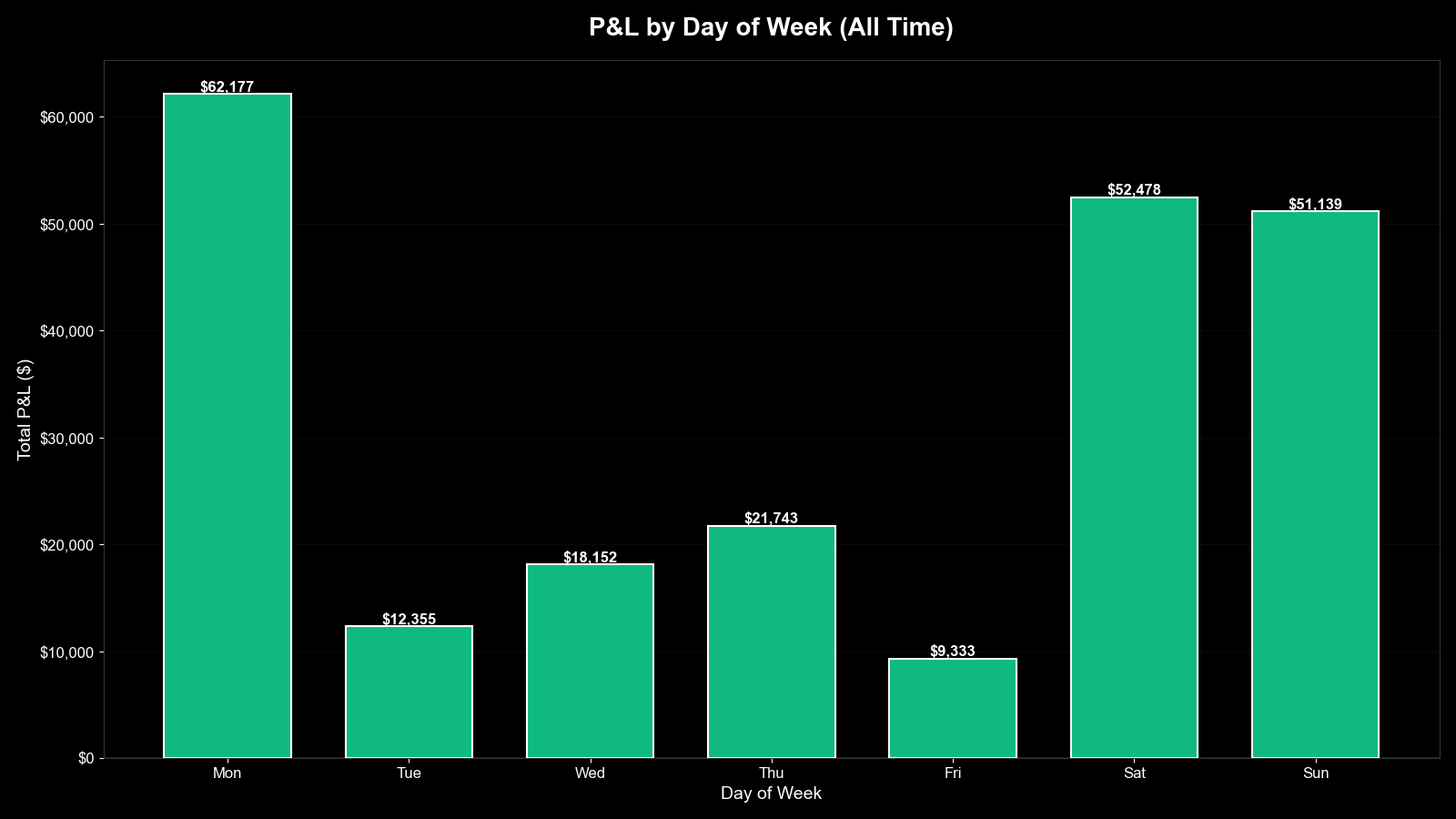

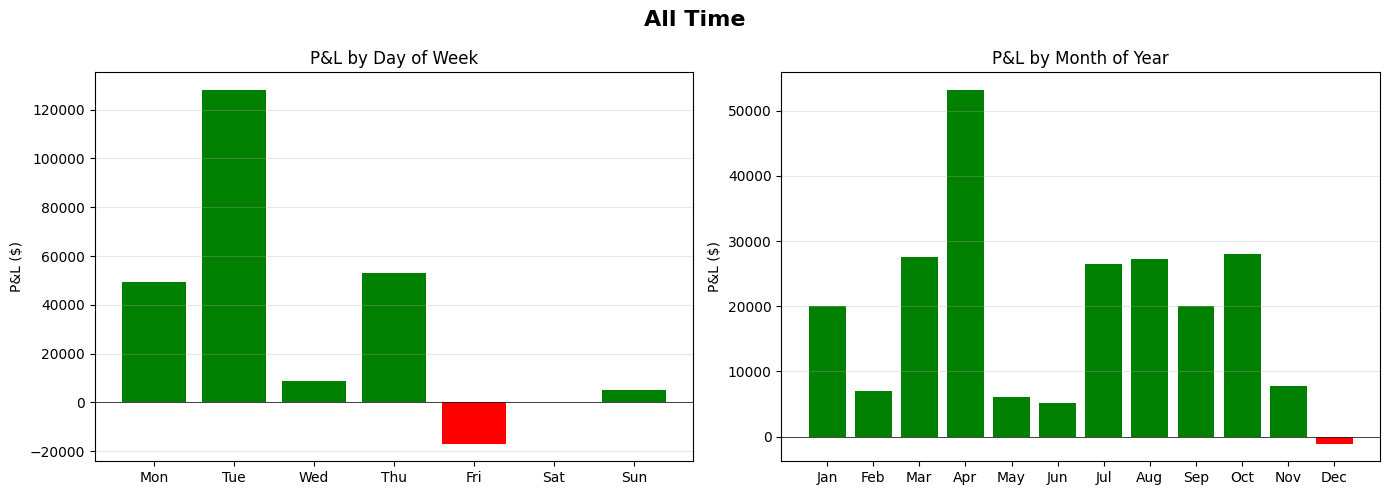

When the Market Moves: Seasonality Patterns

Backtested analysis of performance by day and month

P&L by Day of Week

Monday and Tuesday show the highest activity and profitability. This aligns with London/NY session overlap—when gold is most liquid. Fridays tend to be quieter as traders reduce positions before the weekend.

P&L by Month of Year

Gold tends to perform best during periods of market uncertainty. Notice the seasonal patterns that emerge over 18 years of data. This helps you anticipate when the market might be more volatile.